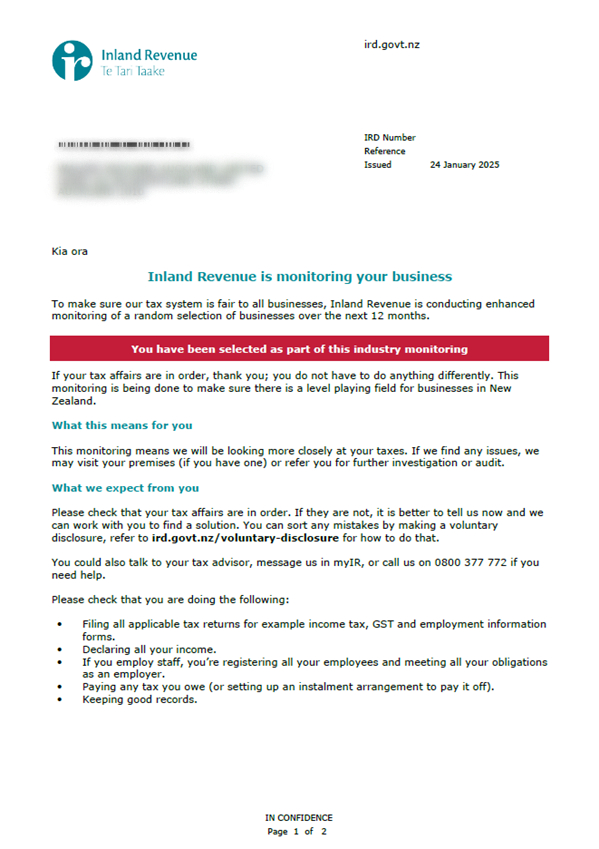

Recently, we’ve seen clients receiving letters from Inland Revenue notifying them that their business has been selected for industry monitoring. If you receive one of these letters, there’s no need for immediate concern—this doesn’t automatically mean an audit is coming your way.

What does this letter mean?

The IRD has increased its focus on compliance as part of its broader business transformation project, which has received $1.5 billion in government funding. By leveraging improved data-matching capabilities and enhanced reporting systems, the IRD aims to ensure that businesses are meeting their tax obligations.

Industry monitoring means the IRD will be looking more closely at tax filings. This could involve requesting additional information to verify aspects of your tax return and assess overall tax compliance. In our experience, the IRD very rarely launches straight into a full audit without first seeking clarification or further details.

What should you do?

If you receive one of these letters, it’s a good time to double-check that your tax affairs are in order. Key areas to review include:

- Filing all applicable tax returns (income tax, GST, and employment information forms).

- Declaring all your income.

- Ensuring employees are properly registered and payroll obligations are met.

- Paying any tax due or arranging an installment plan if needed.

- Keeping accurate and up-to-date records.

If you receive an IRD letter and are unsure about what it means, get in touch with us—we’re happy to review your situation and provide guidance.